kwsp contribution table

On January 1 2018 SOCSO introduced the EIS PERKESO portal to help employers to manage their records update and make contributions. According to epf the statutory 8 contribution rate for employees share will end as of december 2017.

20 Kwsp 7 Contribution Rate Png Kwspblogs

SUMBER epf contribution table pdf.

. Each contribution is to be rounded to nearest rupee. AKTA KUMPULAN WANG SIMPANAN PEKERJA 1991 JADUAL KETIGA Seksyen 43 dan 44A KADAR CARUMAN BULANAN BAHAGIAN A 1. Please try again later.

Rate of contribution for employees social security act 1969 act 4. Employers are required to remit EPF contributions based on this schedule. From RM248001 to 250000.

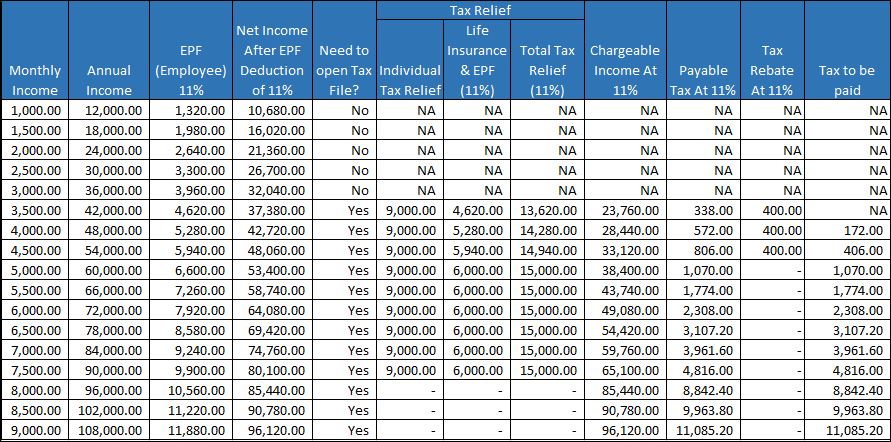

Anyone can contribute to EPF to grow their retirement savings. Kami akan berikan beberapa contoh pengiraan potongan gaji untuk caruman kwsp berdasar rujukan epf contribution table 2022 melibatkan contoh pendapatan RM1000 RM1200 RM1500 RM2000 RM2500 RM3000 RM4000 RM5000 dan RM6000. AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 52001 to 54000 7100 6000 13100 From 54001 to 56000 7300 6200 13500 From 56001 to 58000 7600 6400 14000 From 58001 to 60000 7800 6600 14400.

Employee Insurance System EIS Contribution Table. EPF helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12.

Pada tanggal 8 januari 2018 pt. Example for each employee getting wages above 15000 amount will be 75- 3. Wages up to RM30.

Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. This insurance regulated by the Employment Insurance System Act 2017 and also administered by the EIS SOCSO protects workers between the ages of 18 and 60 who have lost. Contribution By Employer Only.

Whether you are formally or informally employed there is an option for you. The government understands the challenges faced by the people due to prolonged lockdowns and to increase cash in hand EPF will extend the minimum contribution rate from 11 to 9 until June 2022. When wages exceed RM70 but not RM100.

You may consider making an additional voluntary contribution through the self contribution scheme. According to the EPF contribution table. This page is also available in.

When wages exceed RM30 but not RM50. 5 5 choose date of contribution. Epf contributions must be paid in only ringgit denominations and without any cent value.

I-Akaun Activation First Time Login. Flexi has RM200000 and Wages RM200000. Contribution to be paid on up to maximum wage ceiling of 15000- even if PF is paid on higher wages.

The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private. Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. This privilege is only for the first three years of employment.

Cara Pengiraan Potongan Kwsp. Kadar caruman bulanan yang dinyatakan dalam Bahagian ini hendaklah terpakai bagi pekerja yang berikut sehingga pekerja itu mencapai umur enam puluh tahun. A pekerja yang merupakan warganegara Malaysia.

In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. Find out how you can grow your savings today. And for the months where the wages exceed RM2000000 the contribution by the employee shall be calculated at the rate of 55 of the amount of wages for the month and the total contribution which includes cents shall be rounded to the next ringgit.

Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them. Akta 800 ialah akta sistem insurans pekerjaan 2017. Welcome to i-Akaun Employer i-Akaun Employer USER ID.

When wages exceed RM50 but not RM70. Based on the Contribution Rate within the Third Schedule the employers contribution should be RM756 12 while the employees contribution stands at RM567 9. KWSP - EPF contribution rates.

32500 Total EPF Contribution of Flexi is RM55000 Flexi has a salary of RM2000 per month and get a bonus of RM2000 how much does he has to contribute to EPF. Even though a woman employee contributes 8 towards EPF the employer has to maintain its EPF contribution at 12. Employee As monthly remuneration including all liable payments as mentioned above stands at RM6250.

For late contribution payments employers are required to remit contributions in accordance with the third. EDLI contribution to be paid even if member has crossed 58 years age and pension contribution is not payable. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

This brings the total monthly EPF contribution to RM1323. RM200000 RM200000 RM400000. Additional monthly contributions ranging from 265 to 850 will all go to the members WISP account Provident Fund Additional monthly contributions range from 30 to 200 only.

The latest contribution rate for employees and employers effective January 2019 salarywage can be referred in the Third Schedule EPF Act 1991 click to download. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 8001 to 10000 1300 700 2000 From 10001 to 12000 1600 900 2500 From 12001 to 14000 1900 1000 2900 From 14001 to 16000 2100 1200 3300 From 16001 to 18000 2400 1300 3700. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13.

The contribution can also vary in the case of women employees. 2021 CONTRIBUTION SCHEDULE 1 2 3 Additional monthly amount ranges from 10 to 100 only for combined employee and employer shares. Go to kwsp page via official link below.

Monthly contribution rate third schedule.

Employee Provident Fund Epf At Kwsp Epf Act 1991 Act 452 Third Schedule Pdf Factor Income Distribution Employment Compensation

Epf Change Of Contribution Table Ideal Count Solution Facebook

What Is Zionist Zionist Regime Sole Example Of State Terrorism

Epf Interest Rate From 1952 And Epfo

Malaysia Nominal And Real Rates Of Dividend On Epf Balances 1961 1998 Download Table

Download Kwsp Rate 2020 Table Background Kwspblogs

Epf Contribution Rates 1952 2009 Download Table

Epf Contribution Rates 1952 2009 Download Table

20 Kwsp 7 Contribution Rate Png Kwspblogs

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Epf Change Of Contribution Table Ideal Count Solution Facebook

20 Kwsp 7 Contribution Rate Png Kwspblogs

Download Kwsp Rate 2020 Table Background Kwspblogs

Eis Contribution Table 2021 For Payroll System Malaysia

Are You Actually Paying A Lot More Income Tax If You Go For The 8 Epf Cut

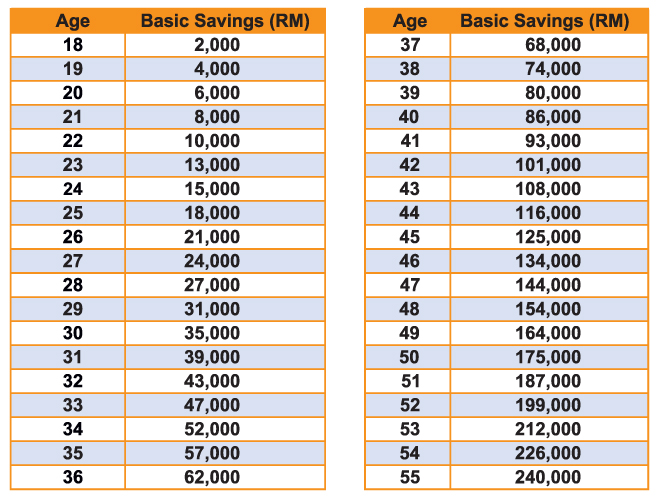

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

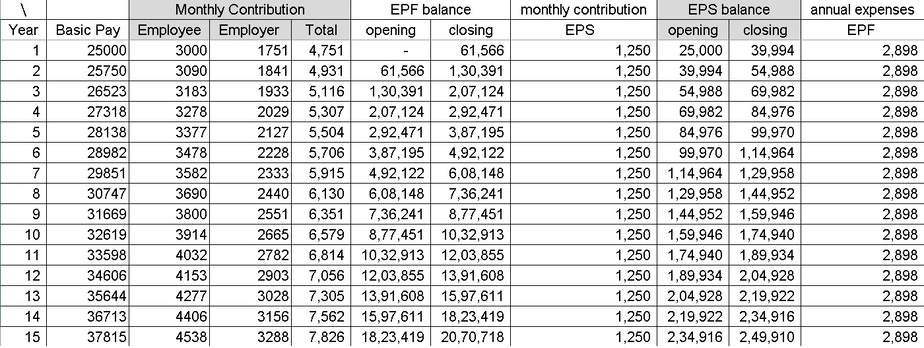

Download Employee Provident Fund Calculator Excel Template Exceldatapro

No comments for "kwsp contribution table"

Post a Comment